On September 16, the Charities Directorate issued its fifth quarterly update.

It emphasizes the need to use digital services, highlights sector outreach and support activities, and summarizes the Directorate’s modernization initiatives.

Digital Services

The newsletter is clear that online filing will be the default method for submitting the T3010 and that this change will be “in the near future.” As a result, charities still using paper returns should take any necessary steps to move to digital filing.

Why digital? The CRA update gives reasons including efficiency, effectiveness, and environment.

The public portion of the return is available online the next day, there is no need to manually enter the information from a paper form into a digital platform which reduces the possibility for errors, and it presumably helps reduce costs for this process, allowing CRA to operate “responsibly and resourcefully” and in alignment with the federal government’s fiscal priorities.

Need help? CCCC has a digital filing option with CRA-certified T3010 software that is free for members and is available to non-members for a nominal fee. We have additional T3010 resources to help you complete the return accurately and on time!

As the newsletter notes, “voluntary compliance is the cornerstone of the Canadian tax system” and that includes T3010 filing. Filing accurately and on time might seem like just another administrative task, but it can also be an important witness for Christian charities. It demonstrates accountability, diligence and both operational and financial integrity.

Sector Outreach and Support Activities

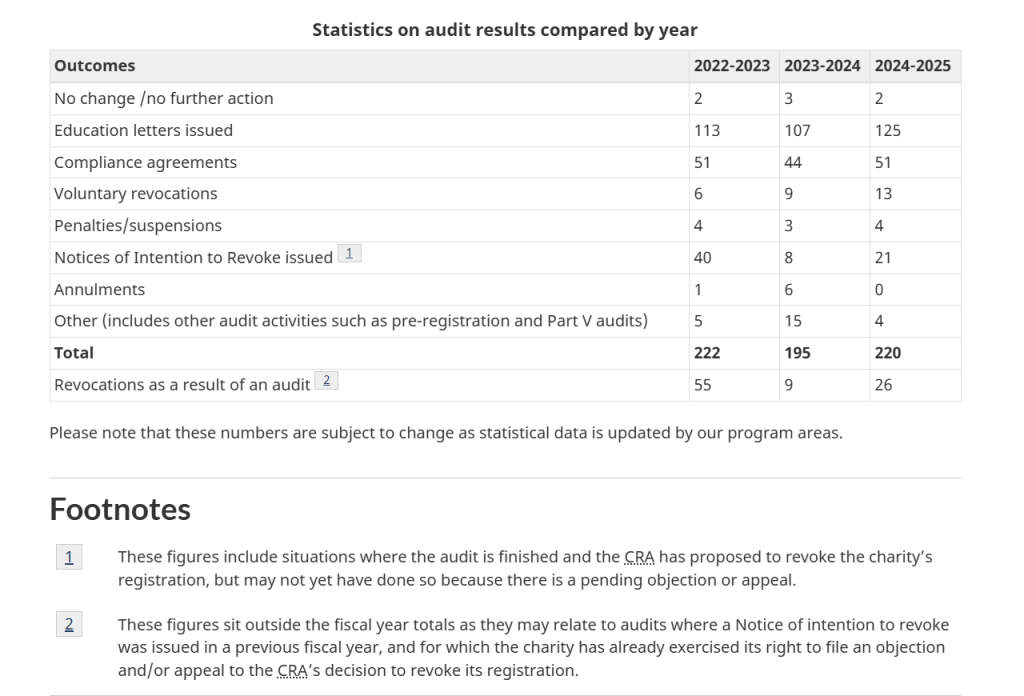

The newsletter links to Directorate outreach activities, including the Technical Issues Working Group (of which CCCC is a member!), presentations, and meeting with international counterparts. Its support activities include recorded webinars (the next topic will be disbursement quota), an updated page for donors, and new statistics about compliance and audits for 2024-2025.

These numbers always make for an interesting read.

In 2024-2025 there was a total of 6,595 non-audit interventions including education letters (5,373), phone calls (1,200), and visits (22). The overall number is a slight decline from 2022-2023 where there were 6,714 non-audit interventions.

Looking at audit outcomes for 2024-2025, the majority result in education letters (125), followed by compliance agreements (51) and a moderate number of notices of intention to revoke (21; “NITR”). The numbers were similar for 2023-2024 though NITRs were lower at 8 and in 2022-2023 the NITR numbers were quite a bit higher at 40, even though the overall number of audit outcomes (222) was virtually the same as 2024-2025 (220).

If you’re wondering how the audit process works you can take a deeper dive with a January 2025 report from the CRA’s Audit, Evaluation and Risk branch. You can also take a look at CRA’s heavily redacted Leads Screening Procedures manual. There is a of content you can’t see, but you can still get a general sense of how CRA handles leads about non-compliance.

Modernization

CRA’s stated goals for modernization are supporting transition to online services, improving timeliness of service (e.g. reduce decision time for charitable registration applications), streamline audit processes, and strengthen educational efforts.

It’s helpful to know what the Charities Directorate has planned, like more digital services and a webinar on the disbursement quota. But if you want to know more now, check out our T3010 resources and the disbursement quota section of our Knowledge Base.

The content provided in this blog is for general information purposes and does not constitute legal or professional advice. Every organization’s circumstances are unique. Before acting on the basis of information contained in this blog, readers should consult with a qualified lawyer for advice specific to their situation.