Canadians in British Columbia, New Brunswick and Saskatchewan will go to the polls this October. There are two key things charities need to remember during election time: give employees enough time off to vote, and do not support or oppose any candidate or political party.

Time off to Vote

To give everyone an opportunity to vote, provincial legislation requires that eligible voters have a certain amount of time off of work to cast their vote.

BC: Four-Hour Window to Vote

BC employers must ensure employees have four consecutive hours free from work to cast their vote. This applies on voting day and can sometimes apply to advance voting (Election Act, RSBC 1996, c 106 s 74).

If an employee’s hours of work don’t give a four-hour window, the employer must give the necessary time off to create a four-hour window.

Exceptions apply to election officials and individuals who are employed in such remote locations that they wouldn’t reasonably be able to reach any voting place during voting hours.

Employers can choose when the time off is given but cannot deduct pay.

SK: Three-Hour Window to Vote

In Saskatchewan, employers must ensure employees have three consecutive hours free from work to vote. This applies while the polling places are open for voting on polling day (The Elections Act, 1996, SS 1996, c E-6.01 s 60).

If an employee’s hours of work don’t give a three-hour window, the employer must give the necessary time off to create a three-hour window.

Employers can choose when the time off is given but cannot deduct pay.

NB: Three-Hour Window to Vote

In New Brunswick, employers must ensure employees have three consecutive hours free from work to vote. This applies while the polls are open on polling day (Elections Act, RSNB 1973, c E-3 s 86).

If an employee’s hours of work don’t give a three-hour window, the employer must give the necessary time off to create a three-hour window.

Employers can choose when the time off is given but cannot deduct pay.

How It Works

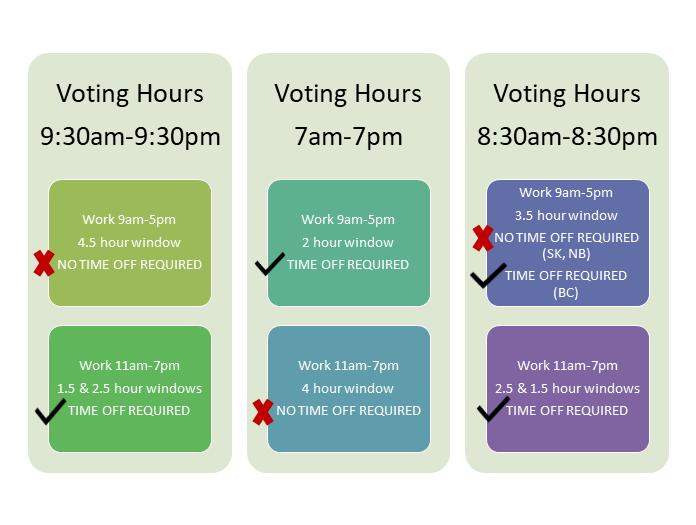

Not sure if you need to give your employees time off? Three simple questions will help you figure it out:

- What are the voting hours in your employee’s riding?

- What are your employee’s work hours?

- Do the work hours allow a 3- or 4-hour window to vote?

If there is already a 3- or 4-hour window, employers don’t have to give extra time off.

If an employee’s work hours do not allow for a 3- or 4-hour window, employers must give enough time off to create it.

Examples

Penalties & Fines for Non-Compliance

Employers cannot deduct pay or impose any penalty on an employee for time off given to vote.

Employers who fail to give time off, deduct pay, or impose penalties can be prosecuted.

In BC, an individual or organization found guilty of violating s.74 is liable to a fine of not more than $10,000 or to imprisonment for no longer than one year, or both (BC Election Act, s 261).

In SK, a person found guilty of violating the Elections Act for a general offence is liable to a fine of no more than $5,000 or to imprisonment for less than two years, or both (SK Election Act s 216).

In NB, a person found guilty of committing an illegal practice is liable to a fine of not less than $240 and no more than $10,200. If a repeat offence, a person is further liable to imprisonment for not more than 90 days. Corporate defendants can be fined up to $9,000 more (s 86(5); Schedule B; Provincial Offences Procedures Act, SNB 1987, c P-22.1, ss 56(6), 57, 63(2), 70(1)(b)).

Need More Info?

If you need more information about ridings (maps, polling stations), voting hours, and candidate lists, check Elections BC, Elections SK, and Elections NB, where all of the official election info can be found.

No Support or Opposition

Charities cannot use any resources for partisan political purposes. That means that no resources can be used for “the direct or indirect support of, or opposition to, any political party or candidate for public office.” Resources is an all-encompassing term. It means financial, human, and physical.

Practically speaking, this means that a charity cannot:

- Endorse candidates or parties

- Tell people to vote for – or not vote for – a candidate or party

- Donate to a candidate or party

- Buy tickets to a candidate or party fundraiser

- Provide staff or board members to canvass door-to-door in their capacity as charity representatives

- Allow staff to volunteer for a candidate or party during paid work hours

- Provide space free of charge or below fair market value to a candidate or party

- Invite only one candidate to speak to the charity’s donors

Charities can still speak about issues relevant to their purposes. Charities can still support or oppose a law, policy or decision of government. Charities can still communicate about the policy positions of candidates and parties. Charities can hold candidates’ debates.

But it must be done without supporting or opposing a candidate or party. What does that look like?

Be Neutral and Focus on Policy Issues Related to Your Charity

Focus on underlying policy issues that further your charitable purposes. Explain that your charity supports policies that (e.g.) affirm the value of religion in society; don’t say that your charity supports a candidate’s position.

Present information about all candidates and parties in a neutral way; don’t highlight policy positions of candidates and parties with which your charity agrees or disagrees.

Invite all candidates to a debate, giving each person an equal opportunity to speak; don’t invite only one or two candidates.

If a candidate or party takes the same position on an issue as your charity, that doesn’t mean your charity is engaging in prohibited activities. CRA notes that even if a candidate or party adopts your charity’s policy approach, shares your charity’s research or comments on your charity itself, your charity is not engaging in prohibited activities so long as those are independent actions of the candidate or party.

For more information, see CRA, CG-027 Public policy dialogue and development activities by charities.

The content provided in this blog is for general information purposes and does not constitute legal or professional advice. Every organization’s circumstances are unique. Before acting on the basis of information contained in this blog, readers should consult with a qualified lawyer for advice specific to their situation.