The Canada Revenue Agency (CRA) has updated the T3010, Registered Charity Information Return and issued a new Form T1441 for qualifying disbursements.

The T3010 requires charities to report grants made to non-qualified donees. The T1441 requires charities to report detailed information about grants made to non-qualified donees. You must use the updated version of the T3010 unless you have already filed a return for your charity’s fiscal period end. If you have already filed, you don’t have to refile.

*UPDATED* T3010 Registered Charity Information Return

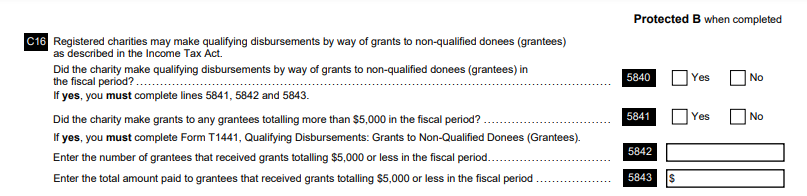

Section C relates to your charity’s programs and general information. New section C16 addresses qualifying disbursements.

You must answer:

- Whether your charity made qualifying disbursements by way of grants to non-qualified donees (grantees) in the fiscal period (line 5840);

- Whether the grants your charity made to any grantees totaled more than $5,000 in the fiscal period (line 5841);

- The number of grantees that received grants less than $5,000 in the fiscal period (line 5842); and,

- The total amount paid to grantees that received grants totaling less than $5,000 in the fiscal period (line 5843).

If your charity made grants to any grantees totalling more than $5,000 in the fiscal period, you have to complete Form T1441.

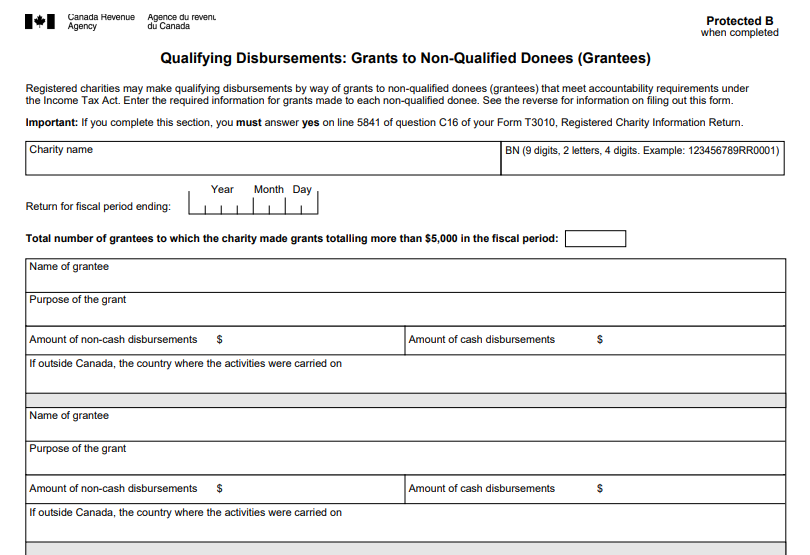

*NEW* T1441 Qualifying Disbursements: Grants to Non-Qualified Donees

The new T1441 Form requires charities to provide more detailed information about grants made to non-qualified donees, and the grant recipients (grantees), including:

- Name of grantee

- Purpose of the grant

- Amount of non-cash disbursements

- Amount of cash disbursements

- If outside of Canada, the country where the activities were carried on

Each grant must be reported individually, and all grants disbursed in the fiscal period must be reported even if the grant activities aren’t complete.

What about the guides?

CRA’s Guide T4033, Complete Form T3010 Registered Charity Information Return has not yet been updated, but CRA has noted it will “in the near future” and it “will provide instructions on how to complete the [revised] T3010 and T1441.”

We are also waiting for CRA to release its updated guidance, CG-032, Registered charities making grants to non-qualified donees which is currently still in draft form. We understand that the revised CG-032 is a high priority for CRA, but we do not yet have a release date. In terms of reporting, the draft guidance (para 80) explains that:

A charity can apply to the CRA to make a special request that certain information not be made available to the public if its release would place the charity, grantee, their staff, or volunteers in danger.

This has been one significant concern for charities that want to make grants. We will have to wait for the final guidance to see whether there is additional clarity and certainty on this application, how they will be assessed, how application is made, etc.

CCCC Fillable T3010 – Updated & Ready!

Did you know that CCCC has a CRA-approved fillable, saveable T3010 to help you with your filing?

We’ve already made updates to Section C, added the new Form T1441, and received approval from CRA, so it is updated and ready for you to use!

Want More Info?

If you’re looking for more information on qualifying disbursements (and the developments that led up to this change), check out these resources…

Blog Posts

CRA Draft Guidance on Making Grants to Non-Qualified Donees

Bill C-19 Has Passed – Impact on Direction and Control (27 June 2022)

Direction and Control – Advocacy Update, Bill C-19 Amendments (6 June 2022)

Direction and Control – Advocacy Opportunity (26 May 2022)

Budget Implementation Act, Bill S-216 and Direction & Control (6 May 2022)

Update: Bill S-216 on Direction and Control (3 March 2022)

Bill S-216 on Direction and Control – Different Name, Same Aim (9 December 2021)

What’s Happening with Bill S-222? (30 June 2021)

Bill S-222: From Direction and Control to Reasonable Steps (10 February 2021)

Knowledge Base & Webinars

For more information on direction and control, see our Resource Page in CCCC Knowledge Base and our webinars Making Grants and the New Rules for Charities and our Fireside Chat where we provide an overview and assessment of qualifying disbursements along with answers to many of your questions.

The content provided in this blog is for general information purposes and does not constitute legal or professional advice. Every organization’s circumstances are unique. Before acting on the basis of information contained in this blog, readers should consult with a qualified lawyer for advice specific to their situation.