As the year draws to a close, Canadian ministries are ramping up their fundraising tactics and communications, encouraging supporters to make meaningful contributions before Giving Tuesday on December 3 and the December 31 donation deadline.

But do you remember to ask for stock donations in your year-end fundraising push?

If not, you could be missing out on a significant source of funding that benefits both your charity and your donors, especially given the market performance of many investors this year! Thanks to the CCCC Community Trust Fund (CTF), accepting stock or mutual fund donations has never been easier for ministries.

Why Encourage Stock Donations?

Donating securities with capital gains, such as stocks, bonds, or mutual funds, directly to a charity offers benefits to donors that cash donations don’t stack up to. It also demonstrates that, while you appreciate their generosity, you also understand the strategic financial landscape that sophisticated donors are in.

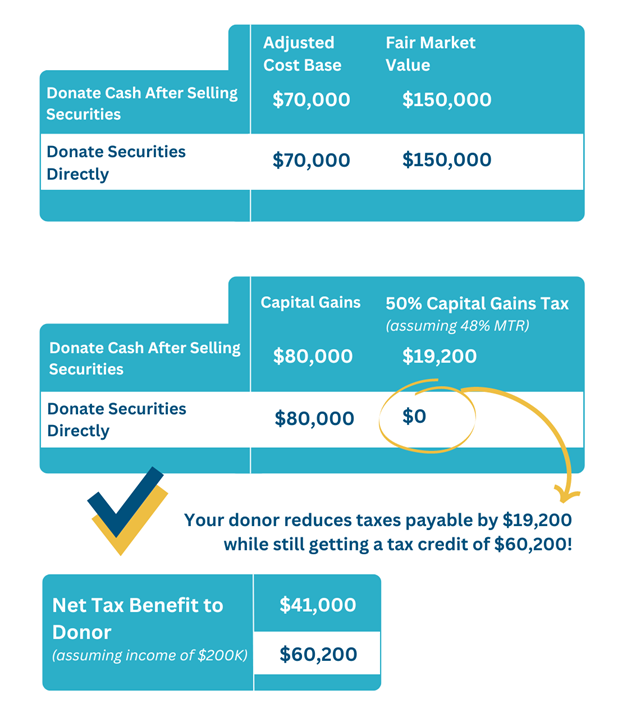

1. Tax Efficiency: Investors enjoyed buoyant markets this year, leaving many with capital gains to sort out – a “good problem” to have! Eligible donors receive a charitable tax receipt for the full market value of the securities at the time of donation, and more importantly, the capital gains tax is waived entirely, allowing donors to maximize the value of their gift.

2. Preserve Cash: Donors can make impactful contributions without dipping into their cash reserves. This is particularly appealing during the holiday season when cash flow might be tight, and cash contributions to investment accounts have already been made.

3. Simplified Giving: We know that our major donors rarely give just one large gift to an individual charity. With CTF, donors can manage multiple charitable gifts through a single transaction, minimizing paperwork and maximizing impact, making that donor’s overall giving that much easier this year.

The CTF Advantage for Charities

Many charities lack the infrastructure or the staff capacity to process securities donations. Managing a brokerage account or navigating the complexities of securities transactions can be daunting, or in times of high volume, they can take away valuable time from finance teams. That’s where the CTF steps in:

- Seamless Processing: CTF accepts the securities, sells them, and distributes the cash proceeds to your charity (or multiple charities) as recommended by the donor and provides a donation receipt to the donors. CTF handles it all, ensuring you can focus on what matters most—your mission.

- Consolidated Reporting: Donors receive one tax receipt for their entire gift, even if it benefits several charities or if they donated multiple securities. This simplicity encourages more donors to give confidently and boldly.

- No Administrative Burden: Your charity doesn’t have to manage any part of the securities sale or receipting. All your team needs to do is ask for the donation and say “Thank You” at the end! (We’ll say “thank you” too)

How to Include Stock Donations in Your Year-End Appeal

1. Educate Your Donors during the year: Include information about the benefits of donating securities in your email campaigns, newsletters, and social media posts. Highlight the tax advantages and ease of the process.

2. Leverage the CTF’s online tool: Reassure your donors that you’ve partnered with a platform equipped to handle these gifts seamlessly, who will work with their team of professionals and financial institutions.

3. Call to Action: Include a direct call to action, such as:

“Maximize your year-end giving impact! Consider donating stocks or mutual funds through the CCCC Community Trust Fund. Visit www.cccc.org/ctf or contact us to learn more.”

4. Provide Examples: Share a story or example showing how a large or major donation has made a significant difference for your charity. If you don’t have one, use the example table above to illustrate the impact of a bold gift.

Make It Easy for Donors

By confidently making the ask, you remove any presumptions or misconceptions that might prevent donors from making large, tax-smart gifts. Don’t let your charity miss out on this opportunity!

As you prepare your year-end appeals, remind your supporters that donating stocks that have risen in value is a powerful way to make a lasting impact, and you can handle it.

For more details about how the CCCC Community Trust Fund can help your charity, visit CCCC’s website. Together, let’s make this year-end giving season the most impactful one yet!